Retirement is the rewarding chapter of life that follows years of hard work. This new beginning, which entails freedom of time, is the chance to enjoy parts of life that could not have otherwise have experienced during the period of income-generating work.

Research has shown that during their retirement, 96% of Indonesians—the highest percentage anywhere in the world—plan to spend their years with family and friends, and 69% of that group wish to spend their savings1. In order for these years to be fulfilling, it should be without the toll of sacrificing one’s family and quality of life due to financial constraints. Retirement should instead be an exciting, enriching, as well as empowering experience, and must be prepared for well ahead of time.

The global economy has been unpredictable over the course of the last few years. This constant state of flux is a good reason to start saving even earlier, as well as being aware of how to protect one’s pension funds against the effects of inflation, recession, and other possible yet unpredictable challenges.

Challenges

1. Increasing Life Expectancy

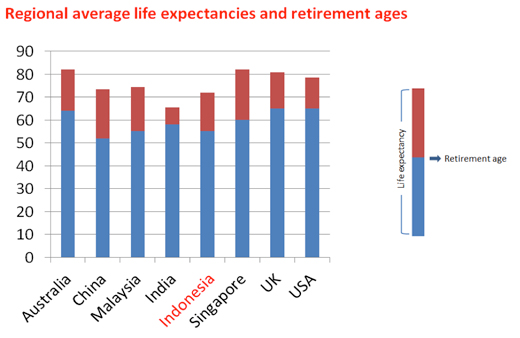

Research has shown that the life expectancy of the general Indonesian population has increased up to an average of seventeen years after the retirement age of 55 years2. This increase alone is indicative of the extent of savings an individual has to consider in order to cover their living experiences in their golden years. These days, Indonesian respondents expect to spend approximately 12 (for men) to 19 (for women) years retired, and their savings are estimated to only last approximately 10 years3. This figure may decrease in the future. Rising living standards coupled with higher life expectancies mean having to increase the amount of savings needed to cover basic expenses during retirement.

2. Surging Inflation in Indonesia

The cost of living has been rapidly escalating in Indonesia. Within one year, the rate of inflation rose from 4.30% in 2012 to 8.38% in 20134, a 195% increase. In order for retirees to maintain their current lifestyles, it is necessary to keep abreast of the trends in the Indonesian financial landscape.

3. Rising Cost of Healthcare

Medical costs in Indonesia have risen at a rate of 4.38% annually since 20065, a significant statistic, considering that the older an individual becomes, the greater the need to invest in healthcare.

4. Increasing Aging Population in Indonesia

By 2030, it is projected that around 37% of the Indonesian population will approach their golden years6. The declining birth rate in the last two decades, combined with the increasing rate of inflation should signal the need to think earlier about life after work.

Start Early. Start Now.

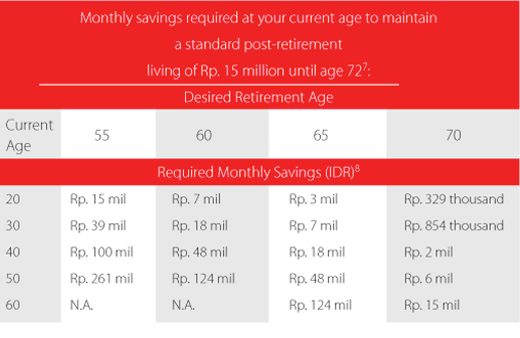

Delaying retirement planning can be costly, as any added moments of hesitation could affect the savings effort and, ultimately, an individual’s experience of their retirement. Even a matter of months can mean more effort in scrounging for millions of rupiah to meet the required monthly savings. The following table illustrates this:

To further illustrate, take a 30-year-old individual making a Rp. 15 million monthly salary. Should they wish to retire at the age of 55, it would be required for them to save up to Rp. 61 million more per month, in order to meet that goal.

The earlier one starts saving for their retirement, the less money they would be required to save each month. With the added benefit of compounded interest, the accumulated amount will also continue to grow over the years.

Set Goals. Plan Well.

For some, the hardest part is getting started. Here is a practical step-by-step guide on how to determine retirement numbers:

1. Target Retirement Savings

•What is your desired retirement age?

•What is your preferred retirement lifestyle?

2. Retirement Savings Period

•How many years do you have to plan for your retirement? (For example: If you are currently 30 years old, and wish to retire at 55, you retirement savings period will be 25 years.)

3. Protection for Your Family

•How much would you need to support your family, and for how long? How would this amount differ, in the event that you are not around to support them?

•How much are your unpaid debts?

•If applicable, what is the approximated reserve for your children’s education?

4. Post-Retirement Living Expenses

•How much are the costs for your accommodation’s basic overhead, i.e. electricity, water, internet, and other utilities?

•How much are your projected medical expenses, given your current lifestyle?

•How much do you spend on your other expenses, such as food, leisure, transportation and clothing? After establishing the age at which you wish to retire and figuring out the required monthly living costs, it is the time to start strategies the proper plan to achieve your retirement goals.